11:49 | 17.01.11 | News | 6364

Business automation companies comment on implementation of electronic tax billing system in Armenia

Yerevan /Mediamax/. Starting from January 1, the changes in the law “On VAT” came into effect. According to those changes, tax billing is realized electronically with the use of an e-invoice program, elaborated by the State Revenue Committee of Armenia.

Commenting on Mediamax’s request on these changes, Head of Accounting Systems’ Department of “ArmSoft” Business Automation System’s Developer Company Samvel Grigoryan stated that despite the fact that the company has introduced all necessary changes in its program, such style of work complicates organization of payments by customers, since the number of steps, related to establishment of a tax account, increases, and the requirements towards technical solutions and the human factor increase as well.

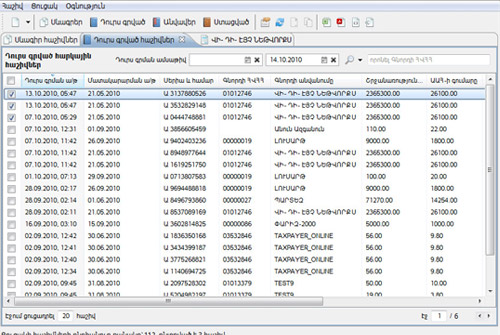

“Before legislative changes, the customer, working with our program, made the following steps: created a sale invoice, estimated it, signed and presented to the buyer. Now, after creation of the invoice, one should convert it into an XML format file, import in the e-invoice program, generate the serial number and the number of the tax account online, after which, in case of necessity, convert it into PDF format, print out, sign and present to the buyer”, Samvel Grigoryan stated.

He added that after that, one should generate the serial number and the number of the tax account in “ArmSoft-Accounting 4.0” program’s system, so that the “Tax Account Reference” is filled in correctly and is provided with feedback in future.

Director of “AcTrade-Soft” Company (elaborator of business automation systems on the basis of 1C software) Tigran Sargsian stated in an interview to Mediamax that their program also allows billing an unlimited number of tax accounts in one XML file, upload it into the e-invoice, after which import the accounts, which have received serial numbers and tax account numbers the same way into the “AcTrade-Accounting” program.

“Nevertheless, in order to work in the program, one should be granted the corresponding right for electronic signature by the State Revenue Committee, the provision of which is delayed, and this is why the taxpayers are forced to temporarily acquire the ready blanks of tax accounts with the indicated serial number and tax account number from the Committee and fill them in by hand. We, in particular, turned to them in order to receive an electronic signature back in December, but we have not so far received the response of the tax bodies”, Tigran Sargsian stated.

According to him, it would be more expedient if the State Revenue Committee provided the taxpayers only with the serial numbers and the numbers of invoices at the given stage, and not their ready blanks.

17:29 | 24.09.25 | Articles

Jacopo Losso on Cross-Border Investments and Why Armenia Attracts Angels